2nd order effects of Cloud proliferation - A startup now serves 2/3rd of America’s Corporate Giants

Digital Identity in a Multi-Cloud World gave birth to a $6Bn company

1. What does Okta do?

Okta, Inc., founded in 2009 by Todd McKinnon and Frederic Kerrest, is a leading provider of cloud-based identity and access management solutions, enabling organizations to securely manage user authentication across various applications and devices. Okta

2. Claim to fame

Pioneering Identity-as-a-Service: Okta introduced a cloud-native platform that transformed how businesses handle digital identities, setting industry standards.

Trusted by Industry Leaders: Serving two-thirds of the Fortune 100, Okta is integral to the security infrastructure of major corporations.

Innovative Leadership: Under CEO Todd McKinnon's guidance, Okta has achieved significant milestones, including a successful IPO and strategic acquisitions.

3. Revenue, Profitability, and Market Cap

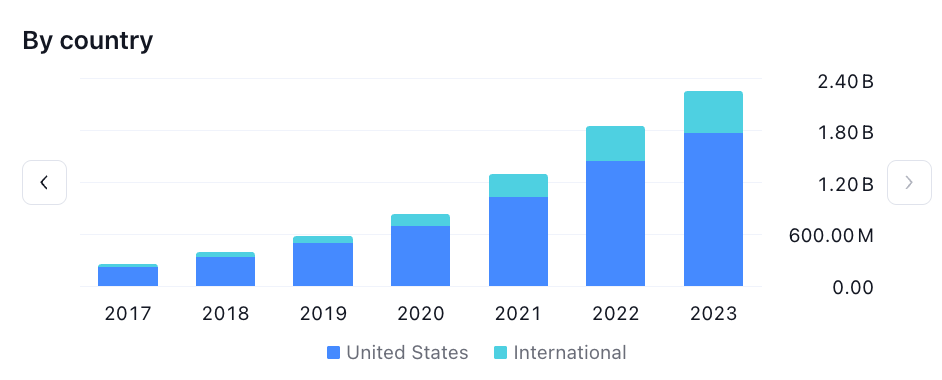

Revenue (2023): $2.26 billion.

Gross Profit: $1.7 Bn

Net Income: -$355Mn

Operating Margin: Non-GAAP operating margin of 17% and a non-GAAP free cash flow margin of at least 19%.

Market Capitalization (November 2024): Approximately $13 billion.

Source: Trading View - Financials | Market Watch | Okta Investors

4. Elliott Wave Prophecy

Long term view - Primary Count

Okta has been undergoing an ABC correction since 2021. Our primary wave count suggests that this correction is still in progress.

According to this count, Wave C is currently playing out, which should lead to prices dropping to $52 or lower.

If prices rise above $116, the odds will shift in favor of the alternate count provided in the next section below.

Long term view - Alternate Count

According to our alternate count, the ABC correction ended in November 2022, and a new impulse wave began at that point.

Wave 1 of this impulse wave concluded earlier this year, and Wave 2 retracement is currently underway.