Simple Speak

Tesla’s recent price action is worrisome. Based on EW it is still in a corrective wave and this price action may not end well in the short term. See our view on Euphoria!

New buyers should NOT jump in now. Wait for it to correct.

Long term investors don’t need to worry. Opportunistic holders can look to take some profits.

Technical Analysis EW

Chart #1 - Long term Tesla still has a good runway and it should do well. However, for traders, which doesn’t look like a very attractive entry point.

Primary Wave Count (Chart #2) - Our view is that Tesla is still in a corrective wave, labeled WXYXZ in Chart #2. Area between 343 & 413 should offer resistance and act as a top for Wave X. I Wave Z, the price should turn lower with targets highlighted in red.

Recent price surge is unusual and can only explained as a bull trap to catch as many FOMO buyers as possible. We have spent time analysing Alternate possibilities but there aren’t many.

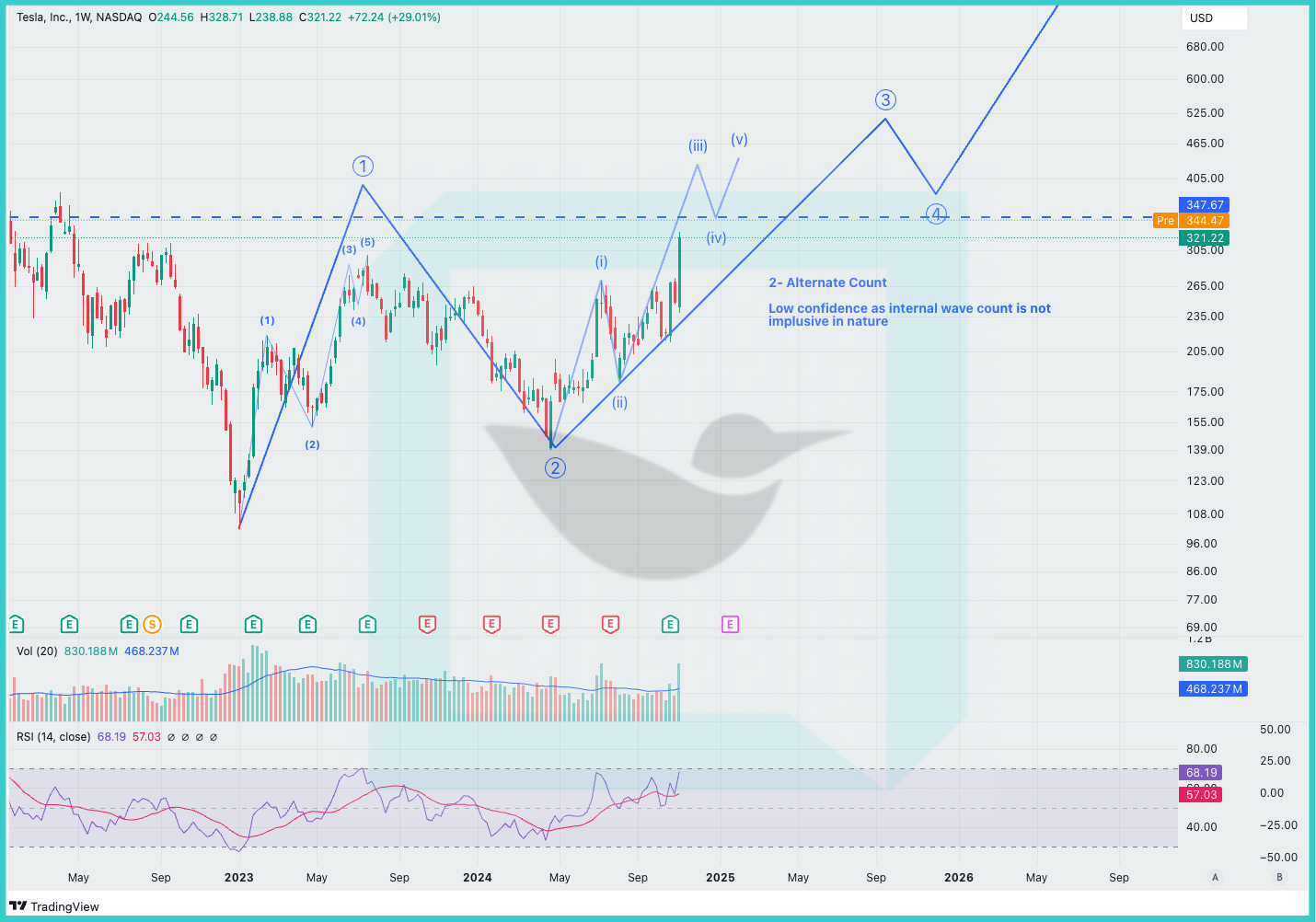

Alternate Count (Chart #3) - We are unable to clearly count internal waves and hence this wave count is of low confidence at this point. If price breaks above 413 then we will evaluate other possibilities.

Chart Speak #1 - Long Term

Chart Speak #2 - Primary Count

Chart Speak #3 - Alternate Count

Previous Update - 14th Oct’24

Elliott Wave Analysis | Tesla CMP: 219.6 | Dt - 14th Oct'24

Tl;dr - Tesla, which has been in a multi-year corrective wave pattern is now nearing its last leg. Once the ongoing retracement ends, it should start its last Wave 5 advance to new highs.

Key Highlights - EW Analysis by AlgoChirp

Corrective Wave 4, following a Symmetrical Triangle pattern, that started in Nov’21 appears to be in its last leg, with one more leg down to go. In this last leg, the price may reach R-Target 1 marked in the Charts below.

When RSI or Price or both break above the sloping trend line then it would be a good indication that Wave 5 has started.

Alternate count - However, if the overall market is weak then it may reach R-Target 2 as well. Which would still keep the current count relevant.

Chart #1 - Weekly

Chart #2 - Daily

Analyst Rating vs EW count

Analyst rating suggests neutral to bearish outlook for Tesla. Per EW, once the current Wave 4 ends, Tesla should hit significantly higher levels in Wave 5.

Long Term - Not in sync with EW count

Short Term - In sync with EW count