Guess what happens next?

Scene 1 - The most valuable public cybersecurity IPO hits a market cap of $10 billion on its first day of trading!

Next - Then it skyrockets to $21 billion—only to drop back down to $2.5 billion.

1. What does Sentinel One do?

SentinelOne is a cybersecurity firm specializing in AI-driven endpoint protection platforms designed to autonomously prevent, detect, and respond to cyber threats. For more information, visit their official website.

SentinelOne has rapidly established itself as a leader in AI-driven autonomous cybersecurity solutions, showcasing remarkable revenue growth of 1,133% from 2017 to 2020.

2. Claim to fame

Leader in AI-Powered Cybersecurity: Recognized for its innovative use of artificial intelligence in threat detection and response.

Industry Recognition: Positioned as a Leader in the Gartner® Magic Quadrant™ for Endpoint Protection Platforms for three consecutive years

Strategic Acquisitions: Expanded capabilities through acquisitions like PingSafe, enhancing cloud security offerings.

3. Revenue, Profitability, and Market Cap

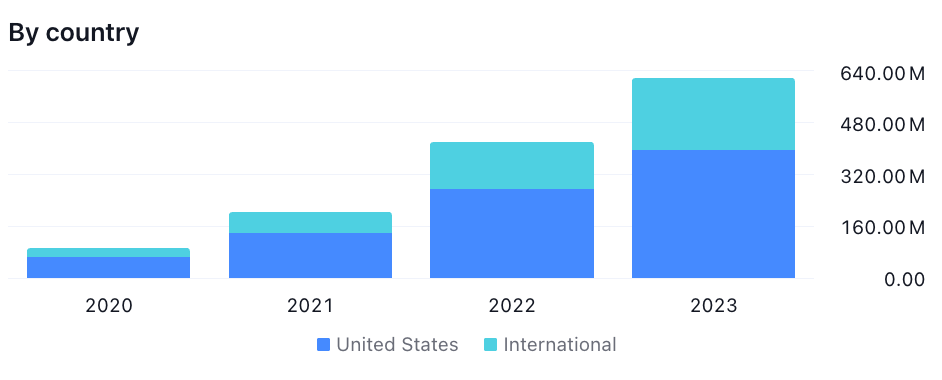

Revenue (2023): $631 Mn.

Profitability: -$338 Mn.

Market Capitalization (November 2024): Approximately $8.9 billion.

Source: Trading View - Financials | Stock Analysis | Macrotrends

4. Elliott Wave Prophecy

Primary Count

Sentinal reached an all-time low in June of this year and has been in an uptrend since then. Our primary count suggests it is currently in the midst of a new impulse wave upward (highlighted in blue in Chart #1).

According to this count, Wave 3 up is now underway. Within this Wave 3, Wave (i) of a smaller degree is nearing completion. If this wave count is correct, the immediate implication is that the price should correct in Wave (ii) before resuming its upward movement.

Chart #2 below illustrates a triangle pattern forming. The conclusion of this pattern is likely to initiate the Wave (ii) pullback.

The price is expected to respect the AVWAP trendline around the $20 area and should not drop below it. If it does fall below this level, we will need to reassess and consider the alternate wave count.

Alternate Count

According to this alternate count, Sentinel has been in a long-term downward trend. The current upward move is merely a corrective pullback, and once it concludes, the stock is expected to resume its decline.

Given the diagonal pattern, a short-term drop appears likely. We will continue to monitor this evolving pattern to determine which of the two counts (primary or alternate) presents the higher probability setup.