[Mid Year Review] QQQ, prediction score 8.5/10

Elliott Wave Analysis | QQQ CMP: 534 | Dt - 17th Jun'25

Predictions at the start of the year

Wave 5 advance (Jan–Feb 2025)

Target: 550

Start of an ABC correction (Feb–Apr/May 2025)

Expect a Wave B retracement, followed by a deeper correction in Wave C

Total correction potential

30%+ decline within the ABC pattern

Score

Wave 5 advance (Jan–Feb 2025)

Target: 550

Actual: 540 on 19th Feb

Score: 9/10

Start of an ABC correction (Feb–Apr/May 2025)

Expect a Wave B retracement, followed by a deeper correction in Wave C

Actual

Wave A drop - 25%

Wave B retracement - Back to 540 range, still ongoing

Score: 8/10 (Doesn’t feel like a 10/10 as Wave B ended up being much stronger)

Total correction potential

30%+ decline within the ABC pattern

Actual - 25% drop in Wave A already. Wave C should atleast reach Target 3 on the chart.

Score: 8/10

Overall Score - 8.5/10

What next?

Primary Count - There is a possibility that the current ABC correction is a flat. If that is true then the upcoming Wave C has a target between 400-370.

However, Wave B is almost equal to Wave A and is not done yet, which raises the possibility of this being a new impulse wave. Which means the next upcoming retracement may be a Wave 2 of a new Five Wave thrust.

Chart Speak #2 - Daily

Previous Post

[2025 outlook] QQQ (Nasdaq) - The next earnings season is likely to spark an ABC correction that could span most of 2025 and result in a 30% decline.

Elliott Wave Analysis | QQQ CMP: 511 | Dt - 2nd Jan'25

2025 Outlook

Simple Speak

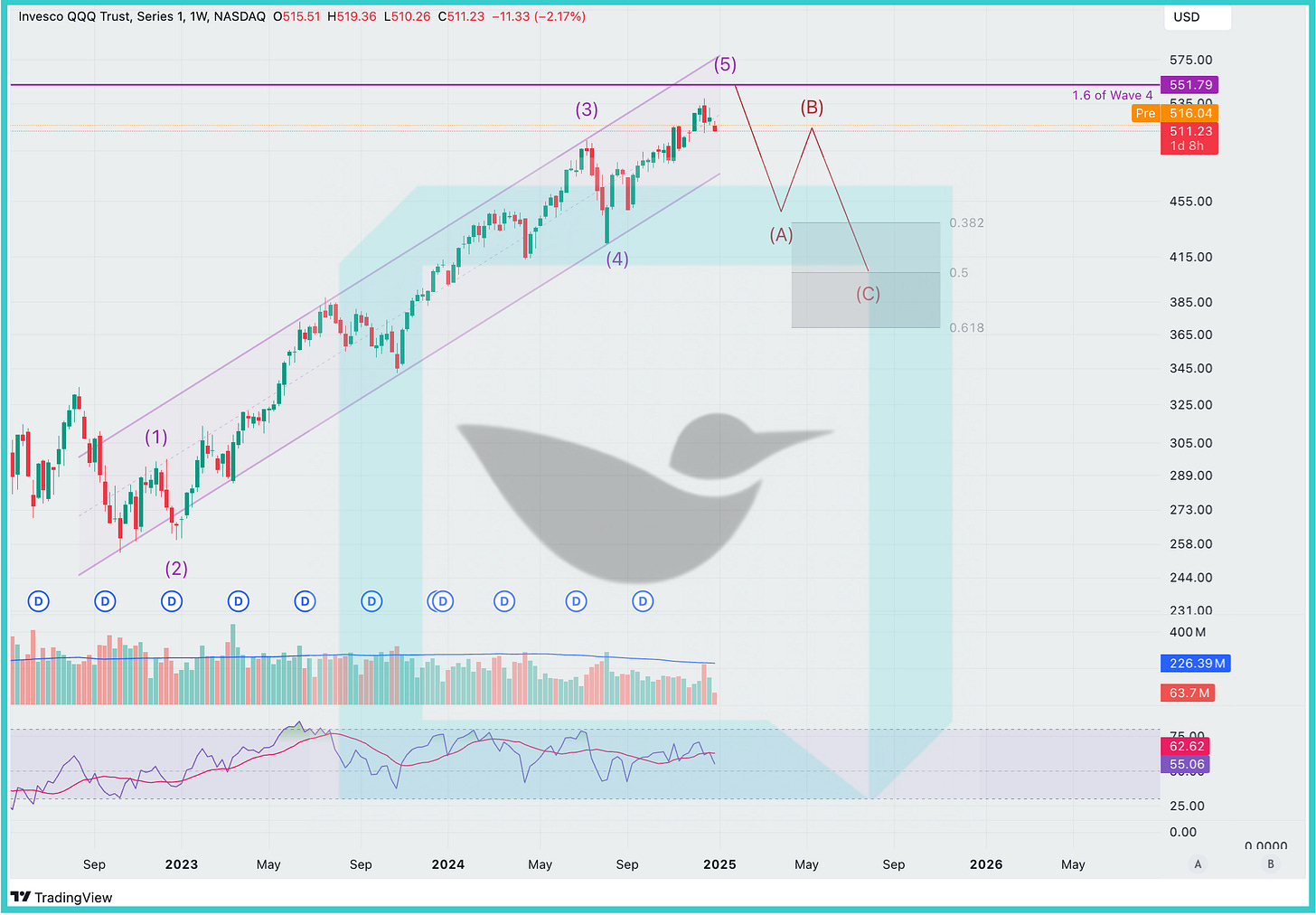

AlgoChirp wave count thus far - The impulse wave that began in October 2022 is now in its final stages. We had anticipated a deeper Wave 4 around the U.S. elections, but that did not occur. Instead, the election results triggered a Wave 5 advance, cutting Wave 4 short. Our latest count for QQQ suggests a Wave 5 top before the next earnings season.

2025 Outlook

Wave 5 advance (Jan–Feb 2025)

Target: 550

Start of an ABC correction (Feb–Apr/May 2025)

Expect a Wave B retracement, followed by a deeper correction in Wave C

Total correction potential

30%+ decline within the ABC pattern

Chart Speak#1 - Weekly

Chart Speak#2 - Daily

Previous Post

Elliott Wave Analysis | QQQ CMP: 496 | Dt - 18th Nov'24

Simple Speak

Next week - EW count suggests a big red candle on the charts!

See the previous QQQ update where we highlighted the likelihood of a Throw Over pattern, what it means and its implications.

It seems the pattern has played out, making next week a critical period. If the Index doesn’t reclaim the recent highs quickly, significant decline could follow. Throw over patterns are rarely pleasant.

The good news, however, is that based on our EW count, Wave 4 is still ongoing and a subsequent Wave 5 rise is still expected. This suggests that while the drop might be meaningful, it’s unlikely to be catastrophic. However, if you’re holding weaker stocks, now might be a good time to prune your positions.

Chart Speak

Previous Update - 7th Nov

Elliott Wave Analysis | QQQ CMP: 505 | Dt - 7th Nov'24

What is a “Throw Under-Throw Over” combo?

In Elliott Wave Theory, a fifth wave approaching the upper trendline on declining volume suggests it may not break the line, whereas heavy volume indicates a potential "throw-over," where the wave exceeds the trendline briefly. This throw-over can be signaled by a prior "throw-under" in waves 4, followed by a swift reversal. Throw-overs complicate wave identification at smaller degrees, as they can cause smaller channels to be temporarily breached by the final wave. However, as long as the ending pattern is visible, this combo (even with some clutter) is a warning for violent reversal ahead.

Simple Speak

QQQ is currently in the final stages of an Ending Triangle pattern, with a reversal likely ahead!

Alternate Count – If the reversal doesn’t occur by early next week, we may need to publish an alternate wave count. However, at this point, we remain confident that this will not be necessary.