Google - OpenAI won't stop it from giving exponential returns in the coming years. However, it'll need to navigate the short-term turbulence that lies ahead

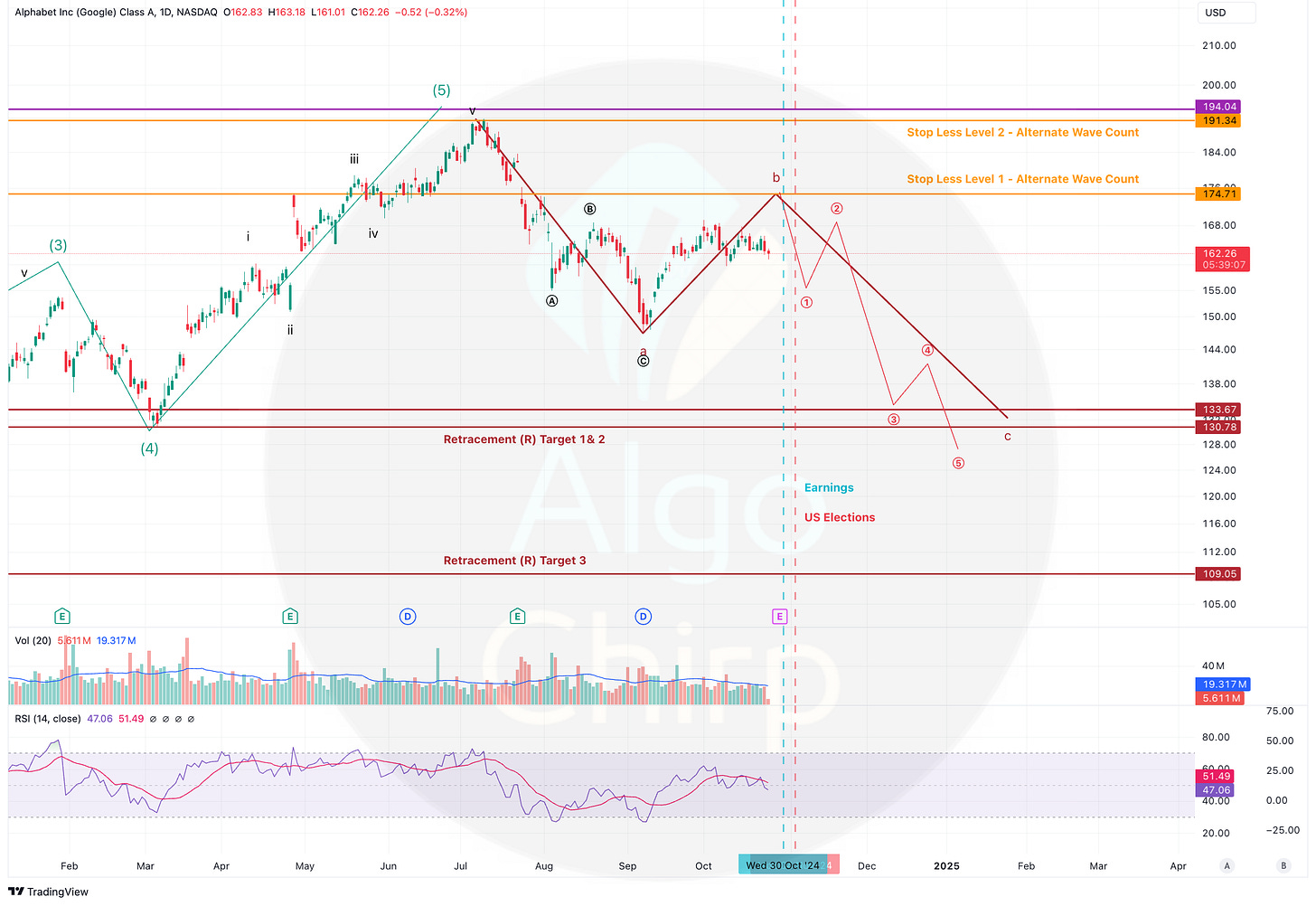

Technical Analysis: Elliott Wave | GOOG CMP: 162 | Dt 10/24

Tl;dr - GOOG, will continue its march higher over the next few years and the current AI wave won’t make the company redundant. However, in the short term there is some turbulence ahead.

Section 1 - Simple speak

Google has had a good run since making a low in Nov’22 and it has made new all time highs in July’24. Based on Elliott Wave technical analysis, the July top marked an end of an impulse wave & hence price started correcting.

This ongoing correction has more room to go and can potentially take the price down to $130-$110 levels over the next few months.

Once this corrective wave is over, Google should resume its upward trend to make new all time highs.

GOOG Chart #1 - Macro view

Section 2 - Technical Analysis using Elliott Waves

Summary

GOOG has been in a massive impulse wave since its IPO. It appears it has completed Primary Wave 3 & Wave 4, and it started the final Wave 5 on Nov’22. Wave 1 of this Primary Wave 5 has traced out five impulse waves of its own.

This Primary Wave 5 should see the price reach new highs, going as high as $500 during the next few years (Chart #2).

However, the first resistance that it is encountering is in the $190 area and that happens to be the end of Wave 1 of a lesser degree. Five wave impulse that started in Nov 22 ended in July 24, near $190 resistance area and since then GOOG started an A-B-C retracement. This corrective way is still ongoing.

It appears this retracement still has some way to go and it may see the price drop to $130, or even to $110 if the overall market turns out to be weak.

Vertical lines in Chart 3 can be seen as inflection points. They represent GOOG Earnings & US Elections.

Alternate count - If the price breaks the Orange stop loss levels then we will need to reconsider the current wave count.

GOOG Chart #2 - Zoom out

GOOG Chart #3 - Technical levels

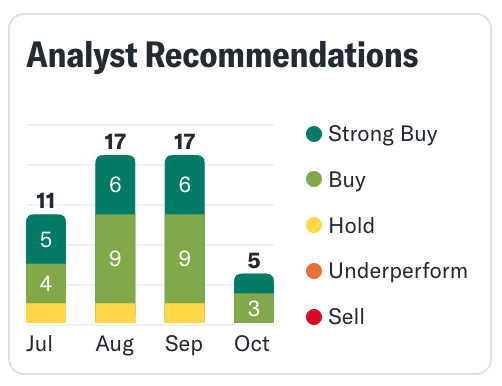

Section 3 - Analyst Rating vs EW count

Analyst rating suggests bullish outlook for Alphabet/GOOG. EW projection however is for the price to start a corrective leg in the short term before resuming the upward trend.

Short Term - Analyst rating is “not in sync” with EW count

Long Term - Analyst rating is “In sync” with EW count