CFSB Bancorp - Penny stock or a potential multi-bagger?

Elliott Wave Analysis | CFSB CMP: 6.88 | Dt 10/29

Tl;dr - CFSB, a tiny bank, is potentially starting its 3rd wave advance. If the count is correct this may see the price rise by ~80%. Given its a small company, with tight risk management rules, it can give superlative results.

Simple speak

CFSB, a tiny regional bank, with a market cap of $45M seem to be on the verge of a Wave 3 breakout.

If this count is correct then it may give a return of anywhere between 40-80% in no time. Technical levels in Chart #2 below

Chart speak

Elliott Wave Analysis

CFSB had been in a prolonged downward spiral, which appeared to end around November 2023. Since then, the price has followed a textbook Wave 1 and Wave 2 pattern.

Wave 1 began from a deeply oversold position, accompanied by significant momentum divergence (see Chart #1). Wave 2 then retraced nearly 78% of Wave 1.

The price is now breaking out of the Wave 2 trendline and may be starting its Wave 3 advance.

Since this is a small company with a low float, caution is advised when considering any position. Based on Chart #2 below, it would be prudent to wait for Wave 2 (of a smaller degree) to play out, potentially retesting the blue trendline, before exploring an entry. This could present a high-confidence setup.

Important note: A tight stop-loss is essential for small stocks; thus, the 78% retracement level is key. Re-entry can be considered if the price rises above this level.

Chart #1 - Zoom out

Chart #2 - Zoom in

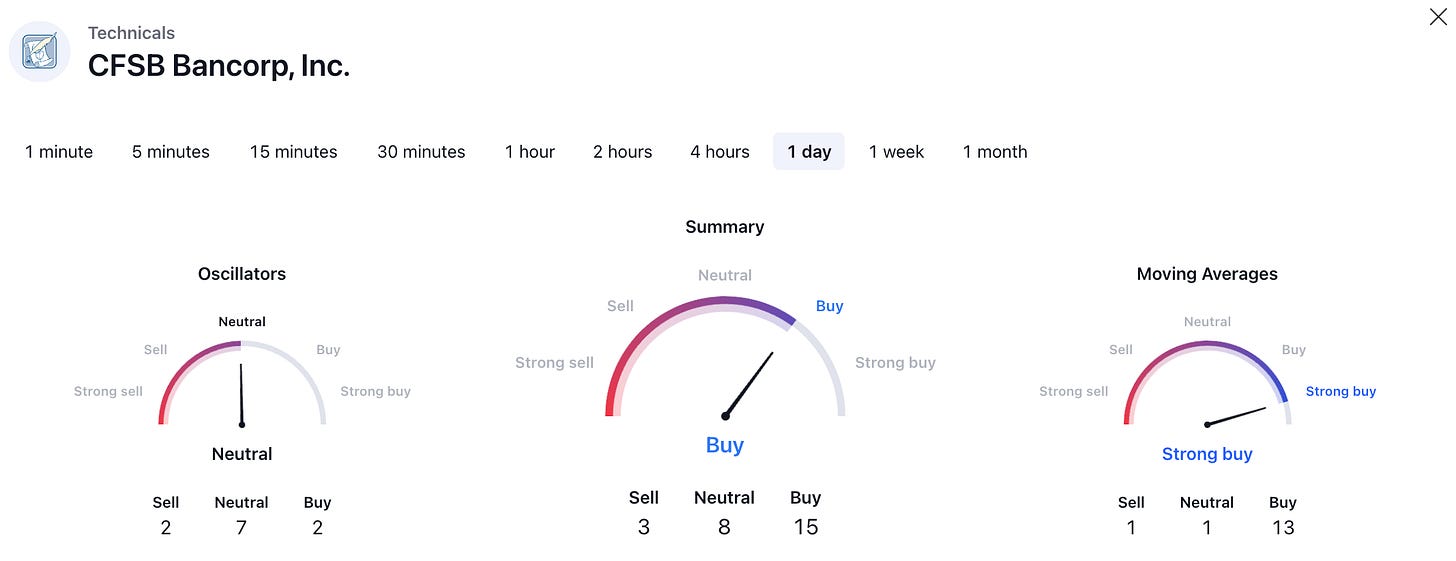

Technicals

Source - Trading View